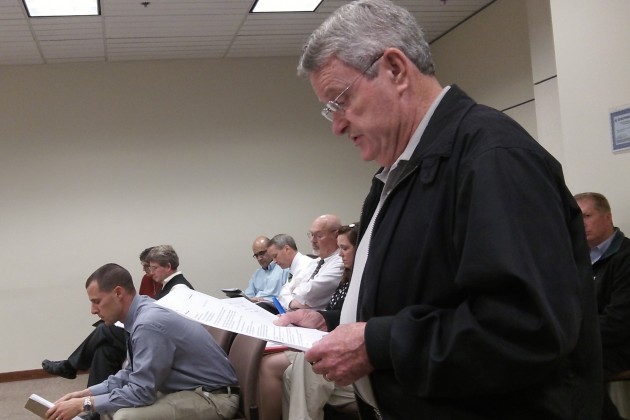

Two years ago, North Albany resident Tom Cordier successfully initiated a charter amendment requiring voter approval of Albany city debt. Today he filed another initiative. This one would require voter approval of city taxes or fees on utility services and cancelling all existing ones after six months if voters don’t approve.

Finance Director Stewart Taylor, handling the matter while City Clerk Mary Dibble is away, said the city has a few days to determine whether to accept the filing. If it does, it will be up to the city attorney to write a ballot title and summary of Cordier’s proposed measure, and Cordier then can try to collect signatures of at least 15 percent of Albany voters to get the proposal on the ballot.

His draft of the measure says the city “shall not” impose or increase “any sales tax, franchise fee, privilege tax or transfer tax without the approval by a majority of Albany voters in a primary or general election.” It also says that any such taxes or fees in effect at the time his proposal is enacted “shall expire in 180 calendar days.”

I was wondering what this might mean, so I looked up the Albany city budget online. It says franchise fees and taxes make up about $5.1 million of the revenue in the $34 million general fund. Total personnel costs for 196 employees in the general fund are $25.6 million. Theoretically then, up to 40 people would have to be laid off if none of the utility fees were approved. Police and fire, by the way, account for 165 of the total personnel in the general fund. (Dividing the personnel budget by the number of budgeted positions yields an average of $130,000 per person. If that seems high to you, it does to me too, even considering that it includes benefits and payroll taxes.)

Cordier had urged the city council to call a public hearing before approving an already budgeted 40 percent increase — from 5 to 7 percent — in the city electric utility tax or franchise fee for Pacific Power, but the council approved the increase Wednesday. Cordier did not take long to react. (hh)

Perhaps many Albany residents don’t know it, but they pay taxes/fees to the city for electric, natural gas, telephone, garbage, cable TV, and telecommunications.

Albany residents, and visitors to Albany, also pay a tax to the city for “privilege of occupancy in any hotel.”

Albany residents, and customers shopping in Albany, will also pay a tax to the city for the “taxable privilege” of buying their medical and recreational marijuana from local merchants. This tax is in the Albany Municipal Code, even though there is an issue with its legality.

Like you said, all of these taxes/fees currently amount to a $5,100,000 burden, most of which is carried by Albany residents.

The petition does not take a position on the acceptability of the taxes/fees. The petition seeks only to give voters, not four members of the city council, the final say on imposing the tax/fee and any increase the city council wants to add on.

There are certain situations where direct democracy produces a better result than representative democracy. One councilor arrogantly calls this “mob rule.” Well, if you are so deluded to think that Albany voters are a “mob” in this instance, then there is little I can offer in reply.

The bottom line – I trust the “mob” more than I trust four councilors when it comes to local taxes/fees.

Hopefully this petition makes it to the ballot. I believe a majority of the “mob” will pass it.

One point: As far as I can tell, the 9 percent hotel tax, or “transient lodging tax,” is not included in the $5.1 million revenue estimate in the budget for this year. (hh)

The scope of the initiative petition includes the transient room tax. The budget for the General Fund identifies $101,500 as a transfer-in from this tax. So it is probably most accurate to say that this petition is focused on $5.3M of pass-through taxes and fees that flow to the General Fund.

Of course, the scope of the initiative also includes the 10% marijuana tax, and nobody knows how much revenue, if any, will result from that tax. If the marijuana tax is legal, we may be talking a significant revenue stream.

Finally, the scope of the initiative petition also includes the gas tax the city council will impose. It is just a matter of time before the Mayor gets her way on that one. Like the marijuana tax, the revenue stream could be significant.

So, let’s just say this petition covers at least $5.3M of taxes/fees, and quite possibly lots more.

Just about any city has a “motel tax”.

It’s basically a conspiracy amongst cities. You tax our citizens and we’ll tax yours. We both make out.

I vacation in N. Idaho once a year and the motel tax in Coeur d’ Alene is 6%.

Finally, somebody called it a 40% increase rather than 2%.

For what it’s worth, the city budget also calls it a 40 percent increase, or 40.53 percent to be exact. (hh)

Evidently Bessie Johnson missed that part of the budget. Her reaction last night made me laugh out loud, especially when Tom did the middle school math for her.

I think the voters will reject this, unfortunately. The ‘voter approval of future utility taxes and fees’ could pass, but the ‘cancelling all existing’ section will be a very tough sell. If it were limited to something like ‘new or raised fees and taxes since January 2015’, perhaps it would stand a better chance. But that would confuse folks as well.

The city taxpayers generally support the city, so the canceling all taxes and fees clause may doom this with the voters. It’ll be very easy for the city to say — if this passes, we’ll have to lay off X number of police/firemen,

While I support the goal to limit such large, arbitrary, tax increases, I wish this petition had focused just on future increases.

-Shawn

The initative petition says existing taxes/fees expire by the 180th calendar day after the initiative’s language is enacted in the charter.

This means the city basically has a choice to make:

1. Refer the taxes/fees they want to voters within that 180 day period. If an election is held within the 180 calendar days, the “expiration” language has no real impact.

2. Do not refer a tax measure. Of course they risk losing everything with this choice on the 181st day.

3. Refer a tax measure after the 180 day period. Of course they risk losing everything for every day they delay a referendum past 180 days.

I believe Tom was very generous in writing the initiative petition to allow the city 180 calendar days to refer a tax measure for voter approval. He had other choices. He chose to give the city a lifeline.

This all assumes the initiative petition makes it to the ballot. I predict it will.

I won’t make a prediction on whether a future tax measure referendum from the city will be approved or disapproved by voters.

Please provide information on where/when we can sign the petition when appropriate. I am one “extreme conservative” that cares about this issue. :-)