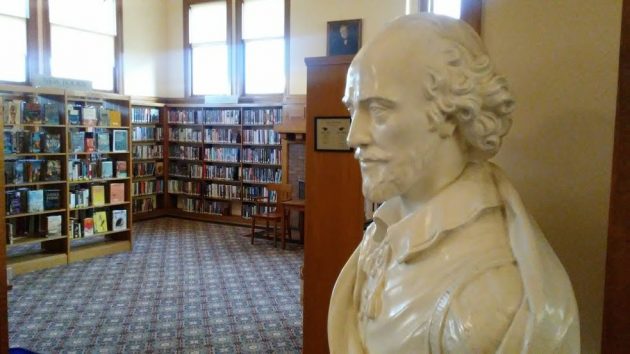

Inside the Carnegie Library. The Shakespeare statue is said to be older than the building, which opened in June 1914.

Closing the Carnegie Library downtown is still not off the table of potential steps the Albany City Council is considering to save money in the next few years. But no definite agreement on that or anything else emerged from yet another round of council budget discussions Wednesday night.

It looks like at an upcoming meeting, the council will consider asking voters in May 2020 to renew a special “local option” levy to augment fire and police department spending. There was some sentiment for raising the tax rate 20 cents over the current $1.15 per thousand dollars of taxable value.

Mayor Sharon Konopa continues to push for replacing the police and fire levy with a monthly utility fee that would be paid by everyone with a water or sewer account, not just owners of taxable property. Nobody has yet determined how hefty the fee would have to be to make up for the levy and possibly raise additional money for other city programs such as library, parks, and streets.

Konopa wants the council to adopt a utility fee on its own. Mike Sykes and other councilors say they would want an election instead.

The 2019-21 city budget of $346,824,157, including the $86.7 million general fund, is balanced. But the council has been warned that Albany may face a shortfall of $11 million in the next two-year budget period. The current general fund, by the way, includes nearly $70 million for the police and fire departments.

As for the Carnegie Library, Councilman Rich Kellum says he was thinking of “repurposing” the building. Just how that would save money is not clear.

Closing the downtown branch would eliminate two jobs and some other expenses for a total savings of $215,00o a year. The layoff would cut the entire library staff by 12.5 percent. This would shorten hours at the main libary and cancel story times for children.

Some $300,000 in recently purchased materials would not be moved to the main library, according to material before the council. (No word on what would be done with it.) Also, the Albany Library Foundation has raised hundreds of thousands of dollars to support the Carnegie, and that effort would be be lost.

There was some talk Wednesday about forming a countywide library district. While that would shift library expenses away from the city, it would add another tax to Albany taxpayers without yielding any additional service. It’s hard to see voters being wild about that.

The council did appear to favor adding a fee of $25 or more to the fines for criminal convictions in municipal court. This would pay for appointing lawyers to defend indigents in city court, an expense that may rise to $80,000 a year.

An unrelated proposal for asking voters to approve a $19 million bond issue for repaving segments of six major sreets generated no council support. Councilors worried about overwheling voters with tax elections.

The council’s next meeting is a work session at 4 p.m. Oct. 21. Some of this may come up again then, or it may not. It was hard to tell from the back and forth Wednesday which direction the council would take. (hh)

Social justice demands that the city take more from the freeloaders and the wealthy.

1. Tax the property of non-profits: hospital, LBCC, churches, carousel, etc. They all consume city services and must be force to pay their own way.

2. Tax the personal property of rich people. If you have over $10,000 of stuff, then the city should take 25% of every dollar between $10k-$100k, and 49% of every dollar over $100k.

This is low hanging fruit every progressive will support.

A lot of low hanging fruit there Shadle. Thanks for reminding everyone about Churches and the weathly well to do crowd. Both should foot this bill and roads.

But what about that Soda “SIN” tax?

Hey, I’m all for city government trying to control the behavior of its residents. A tax that enables government control is so much better than education and consumer choice.

And think of the new revenue stream that will fund more city services.

Once these revenues are baked into the city budget it will be impossible to get rid of the tax. Yeah!

In fact, the council will have to encourage consumers to drink more sugary drinks to guarantee that peak money flows into future budgets to keep those essential services going. These are good things.

The only question is, how will the council encourage people to drink more sugary drinks so the revenue stream is protected? And, what new attempt to control behavior and increase revenues through new taxes will be next? Oh, the possibilities are endless.

Regressive taxes like this are so exciting for the average resident.

Let’s do this!

When it comes to the soda tax/fee, put your blinders on and ignore old guys whose health is failing.

The City of Albany must satisfy its addiction. Onward!

https://www.phillymag.com/citified/2016/04/24/bernie-sanders-soda-tax-op-ed/

Wow! Took the bait and EAT IT! LOL

Adding an additional $25 to “convicted” muni-court violators is nonsense! They don’t pay their fines as it is now! When I retired from the PD in Dec ’00 there were two large file cabinets in the dispatch center full from A to Z with “Fail to Pay” warrants. More often than not when caught they’d just get another ticket & another charge added to the 2nd charge which was for the 1st charge….get my drift??!! No use lodging them in our county jail as the sheriff charges a heft price for 3 hots & a cot!

Does Carnegie library generate enough users when I lived in Albany I went to the other library which served my purpose

“The council did appear to favor adding a fee of $25 or more to the fines for criminal convictions in municipal court.”

And reimburse those found innocent for their trouble?

Just to keep things fair-

People who are found innocent or have charges dismissed don’t get fined in the first place.

I know they don’t get fined, but they sure get inconvenienced severely for apparently doing nothing wrong.

Still trying to fully understand what a levy is under our current property tax laws, Measure 5, Measure 47, Measure 50, Measure 56. The levy seems to be designed to bypass the constitutional limits placed by Measure 50 (M50) and they seem very easy to pass because it only takes about 14% of the voters to pass with the repeal of the Measure 47 double majority under Measure 56. Under our current system M50, you’re taxed at 1.5% of the assessed value (AV) of your property, that’s the 1997/98 value of the property increased every year by 3% compounded annually. This AV amount is usually less than the current Real Market Value (RMV) of the property, unless you have a crash like in 2007/2008. What the levy allows is additional taxation up to the RMV of the property, the amount over and above the AV value. Total taxes are determined by taking 1.5% plus the levies multiplied against the AV plus whatever bond debt has to be paid back (paid first). The key is the tax of the levies plus the 1.5%, multiplied against the AV has to be less than the amount of 1.5% multiplied against the RMV; the maximum tax allowed under Measure 5 (M5). When the assessor has to reduce the tax liability amount because the AV tax liability comes in higher than the allowable M5 maximum 1.5% of RMV, that’s called compression. You could pass a levy of a $100 per thousand assessed on AV but the assessor can only tax up to the maximum of 1.5% of the RMV plus bond debt, the rest has to written off. You can see there’s an interest by the assessor to always try and keep enough of a gap between AV and RMV so that he doesn’t have to cut back on the amounts assessed by the levies. That’s one of the main components Albany/County/Schools use when setting up the budgets, they look at their portion of the 1.5% (1% city/county, 1/2 percent schools) plus the levies at the full taxation rate, when they don’t get that full taxation rate, it throws the whole budget into uncertainty.

I just think council needs to step back and start looking at some of this differently. Putting taxation on the back of basic living necessities like housing, electricity, water, sewer, is just putting so much pressure on individuals. Why can’t you look into an Alex Johnson platform? His taxation of sugar related products has a lot of merit, he’s a new voice and he’s got good ideas. Look around at the population, look at the visceral fat around the midsections of our fellow citizens, it’s killing them, yet you want to make it harder for them to obtain housing?

No question the “soda tax” makes for good social engineering, but 3 problems IMO:

1. As with all taxes, it will require a vote of the people and

2. It will generate a minuscule amount of dollars in the grand scheme of things and

3. This budgetary “crunch” will be getting much-much larger in the next couple of budget cycles.

The serious heavy-lifting will not happen this go’round – regardless of the current angst portrayed…

It’s going to get a lot worse if the RMV’s start getting close to the AV levels, that scenario will negate the levies. I think that’s why the Mayor is pushing for the utility tax, she knows a downturn in the property market will devastate the city if they’re having to rely just on the 1.5% of the RMV. It’s going to be worse this time around because of all those additional 3% increases that have compounded, the cushion between RMV and AV has diminished. At some point the RMV and AV will intersect and that’s when it gets ugly.

You really think a soda tax would be minimal? With the amount that is consumed? I just don’t see how putting additional stress on basic housing and subsistence needs is a viable long term solution. It’s a short term easy fix because people have to have it to live and it’s not an option to go without plus in terms of real property, it can’t be moved, you have a captive audience. But it’s also destructive to a community, each time there’s an increase in shelter costs more people are hurt and it’s usually those most vulnerable.

We just don’t have that many options to generate taxes across the entire population, and the existing tax options are distressed plus the pool of those paying the bills for local government is diminishing. I just like the fact Alex is trying to think outside the box.

Spot on with your last sentence. I simply think the Soda Tax is a real no-brainer to have, but doubt it would make a material “dent” in the budget shortfall.

What do you think about a coffee tax, there’s a lot of coffee being consumed? I would say tea, but I would be afraid the citizens would start sinking all the government vehicles in the river. Should we ask what King George III would have done?

Decided to wait for the usual discussion.

Why the push to close down a facility that accounts for about 0.05% of the city budget? That won’t wiggle the meter at all. Frankly, it could be a cultural magnet.

The push to pay for providing services via fee gives me a queasy feeling. First of all, the service fee isn’t deductible. Second, well, I’ll just let GS and TC speak…..

Think Carnegie closure may already be a done deal. Anyone aware Main Library has

moved many of its bookcases and beautiful oversize books to the unknowns. Appears

they are already expecting some major change?